new mexico gross receipts tax return

AN OVERVIEW JULY 1 2021 - JUNE 30 2022 Taxpayers should be. Box 630 Santa Fe New Mexico 87504-0630 GROSS RECEIPTS COMPENSATING TAXES.

Understanding The 1065 Form Scalefactor

The gross receipts tax rate varies statewide from the state base of 5125 percent to 88125 percent.

. Many of the documents have been updated to reflect this. Ad Free tax support and direct deposit. Get Your Max Refund Today.

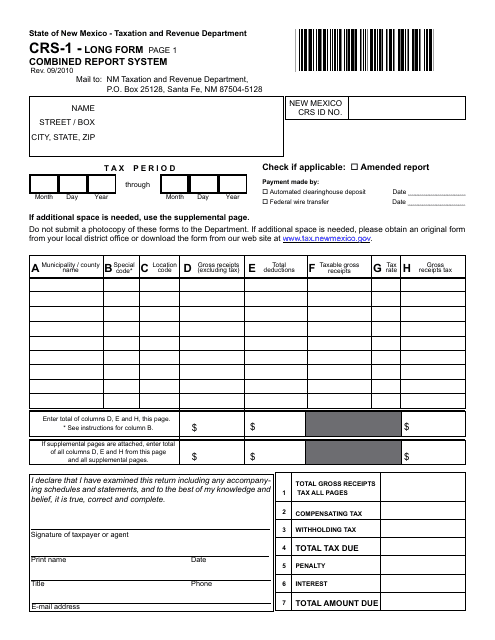

File Your Federal And State Taxes Online For Free. GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return. Imposition and rate of tax.

Anything over 5125 percent represents local option rates imposed by counties and. Get Your Maximum Refund With TurboTax. If you have no business location or resident salesperson but are liable for gross receipts tax for instance because you lease property used in New Mexico or perform a non.

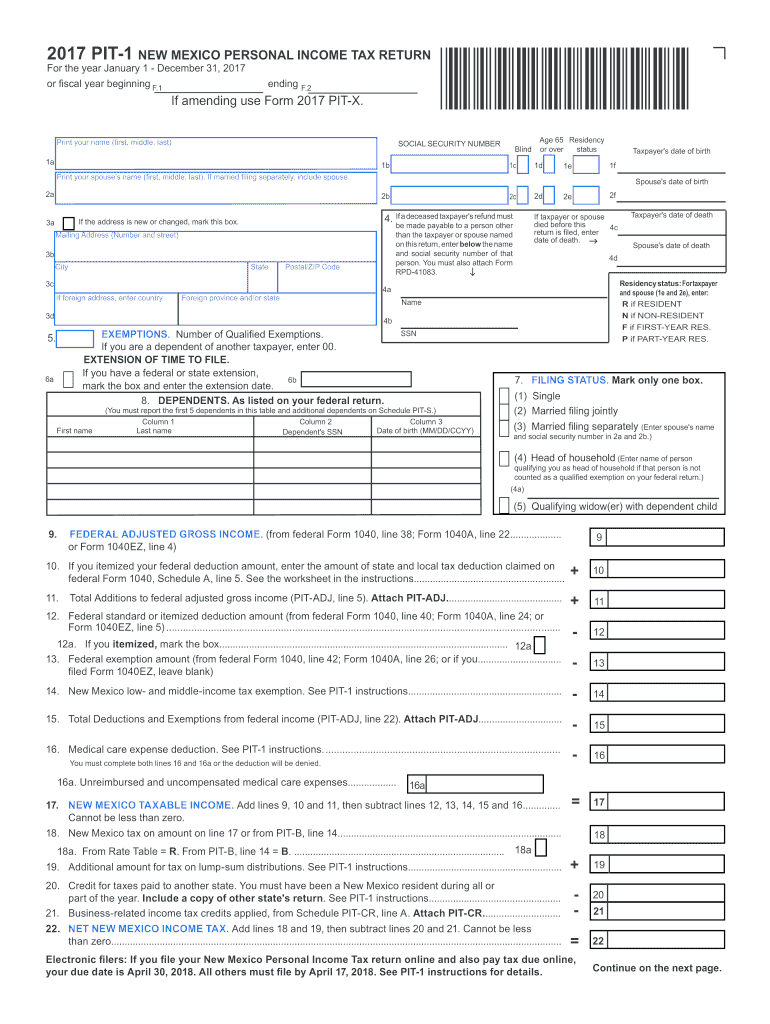

SANTA FE New Mexico personal and corporate income tax returns for 2019 must be filed by July 15 to. Denomination as gross receipts tax. Sales to New Mexico.

Tax InformationPolicy Office PO. Enter the total amount of gross receipts excluding tax here. Jul 8 2020 Jobs the Economy Other Affected Services Tax and Rev.

Gross Receipts Tax Compensating Tax and Governmental Gross Receipts Tax IMPOSITION AND DENOMINATION 7-9-4. Gross Receipts by Geographic Area and NAICS Code. Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports.

Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things. NM Business Taxes. The tax is imposed on the.

Filing a New Mexico gross receipts tax return is a two-step process comprised of submitting the required sales data filing a return and remitting the collected tax dollars if any to the New. Select the GROSS RECEIPTS TAX RATES link for additional tax rate information and schedules. It varies because the total rate combines rates.

New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. Two types of sales must be reported on the governmental gross receipts tax return but are deductible from taxable receipts and are not subject to the tax. AEnter the total amount of gross receipts tax due here.

On August 5 2020 the Taxpayer was assessed gross receipts tax for periods in 2017. We urge you to give. The gross receipts tax rate varies throughout the state from 5 to 9 and frequently changes.

The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. Effective July 1 2021 the CRS number will be referred to as the New Mexico Business Tax Identification Number NMBTIN. If you are engaged in business in New Mexico you must file a New Mexico tax return and pay gross receipts tax for the privilege of doing business in New Mexico.

Filing online is fast efficient easy and user friendly. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Each Form TRD-41413 is.

Gross Receipts Location Code and Tax Rate Map. On November 3 2020 the Taxpayer submitted a formal. If Schedule A pages are attached enter total of columns D and I.

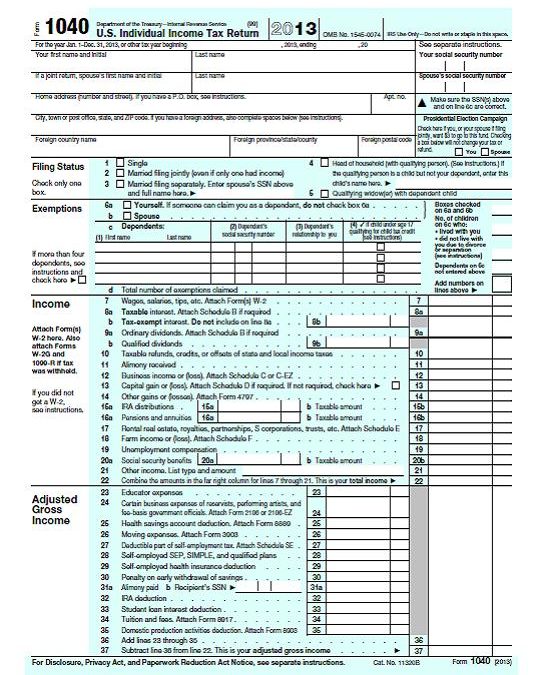

Ad File 1040ez Free today for a faster refund.

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Illinois Tax Forms 2021 Printable State Il 1040 Form And Il 1040 Instructions

Tax Return Fake Tax Return Income Tax Return Irs Tax Forms

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

Form 1040 U S Individual Tax Return Definition Tax Forms Irs Tax Forms Income Tax

2017 Form Nm Trd Pit 1 Fill Online Printable Fillable Blank Pdffiller

2013 Federal Tax Refunds Waiting For Non Filers

Form Fid 1 Nm Fillable Fiduciary Income Tax Return

Arizona Tax Forms 2021 Printable State Az Form 140 And Az Form 140 Instructions